This is an article for training purposes. I'm pretty sure there is official documentation on how to do this but I thought I'd write this article to make it simpler for new developers to follow and learn as a quick point of reference.

Why?

Some clients systems will presume that they don't need their sales or CRM users to think about tax and probably manage it in Zoho Books leaving it to their finance team. This is a quick run-through for a standard setup to include UK tax/vat.

How?

Here's a quick step-by-step to follow:

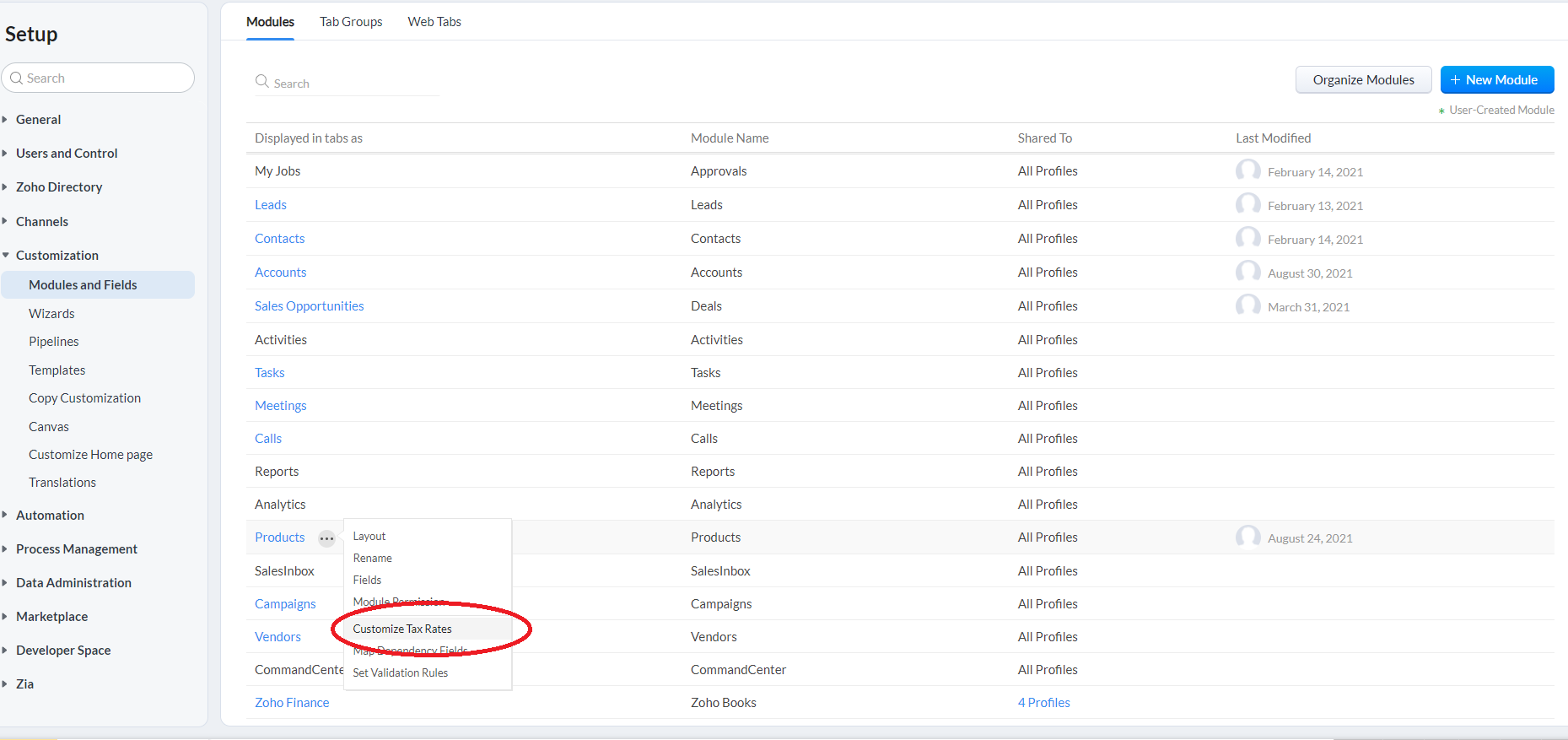

- Login to ZohoCRM as an Administrator

- Go to Setup > Customization > Modules and Fields

- Hover the mouse cursor over the "Products" module and then over the ellipsis

- Click on "Customize Tax Rates"

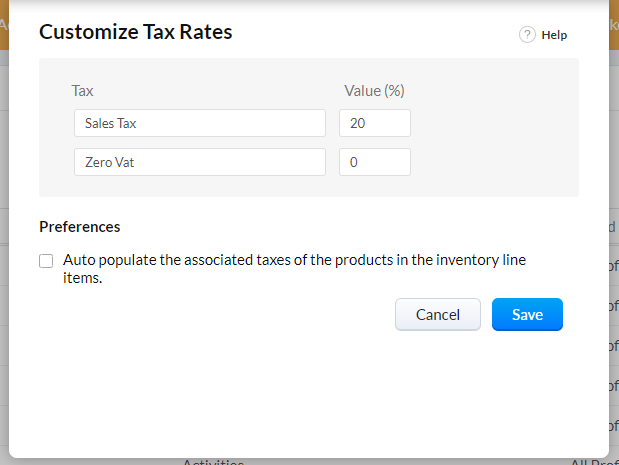

- For our clients in the UK, we tend to specify the tax rates as "Standard Tax" @ 20% and a "Zero Vat" @ 0%

- Click on "Save" and you've pretty much specified the tax rates that this CRM can use; but... do the next steps for users to be able to use these.

To have this selectable for users in their transactional modules (quotes, sales orders, invoices, purchase orders), you need to modify each product record (can be done with "Mass Update") to give them the applicable tax rates:

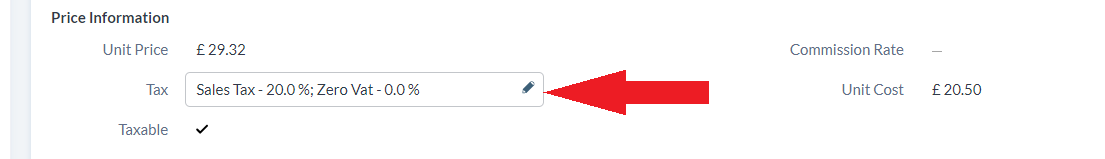

- Browse to a CRM product record (you can do mass edit on a listview of products but for demo purposes, we'll do just one)

- Under Price Information, edit the field "Tax" (multi-select) and select both tax rates

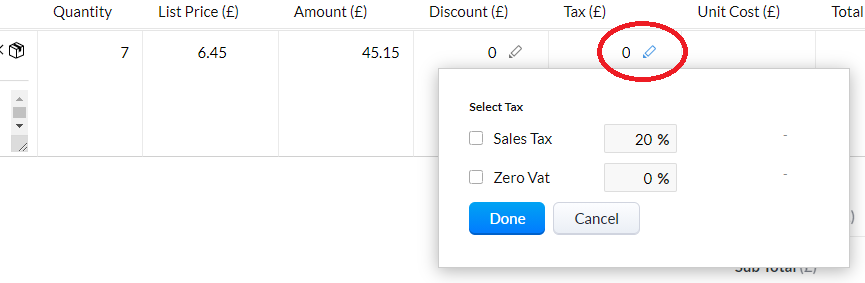

- Now go to a transactional module that has line items and use the product

- When you click on the edit icon in the line item "Tax" you will see both options available to be ticked, the same popup will appear if you click on the edit icon in the header "Tax" (applies to subtotal).

Note:

- If you do not do the second section as per this article, even having customized the tax rates, when selecting a product that has no tax rates against it and clicking on the edit icon for Tax at the line item level (at header level is unaffected and all tax rates are selectable: in the aggregate fields section), the user will get a popup saying something like "No tax associated with this product.".

For CRM REST API:

copyraw

r_TaxRates = invokeUrl

[

url: "https://www.zohoapis.com/crm/v6/org/taxes"

type: GET

connection: "zcrm"

];

info r_TaxRates;

// list tax rates

l_Taxes = ifnull(r_TaxRates.get("org_taxes").get("taxes"),List());

- r_TaxRates = invokeUrl

- [

- url: "https://www.zohoapis.com/crm/v6/org/taxes"

- type: GET

- connection: "zcrm"

- ];

- info r_TaxRates;

- // list tax rates

- l_Taxes = ifnull(r_TaxRates.get("org_taxes").get("taxes"),List());

Source(s):

Category: Zoho :: Article: 765

Add comment